China Evergrande Group’s stock was revitalized prior to paring the development, a sign that financial backers stay attentive over obligation talks as the bothered engineer faces a key coupon installment test on a dollar bond.

The Hong Kong-recorded offers surrendered gains of as much as 32% to end Thursday almost 18% higher. The prior flood came as a deferred response to news that a unit of the designer had arranged interest installments on yuan notes, with exchanging shut Wednesday for a vacation.

“The ‘settled’ coastal coupon presumably flagged that the specialists are attempting to contain a dislocated default and chipping away at a rebuilding plan,” said Thu Ha Chow, a portfolio supervisor at Loomis Sayles Investments Asia Pte. “The property area keeps on excess exceptionally unpredictable as it hangs tight for a goal for Evergrande. The speedy ascent was presumably because of short-covering yet it appears as though there are still venders into strength.”

With a coupon installment due on Evergrande’s 2022 dollar bond on Thursday, merchants have been searching for any signs that the world’s most-obliged designer would have the option to explore its direction through US$300 billion of liabilities without going into default. While Evergrande’s inland property unit didn’t give subtleties on the arranged yuan bond installment in its Wednesday explanation, it was the primary hint spread out on the guide.

Evergrande’s bounce back prodded a more extensive convention in Chinese stocks and the obligations of different designers, which had been sold before on infection dread. Also, in an indication of help for the unpredictable market, China’s national bank siphoned the most transient liquidity in eight months into the monetary framework.

The convention in Evergrande’s Hong Kong stock has seen around 738 million offers change hands, contrasted and the one-year every day normal of 40 million. Short interest as a level of its free buoy dropped to 15 percent on Tuesday from around 20% 10 days prior, as indicated by the most recent IHS Markit information.

In any case, a significant supporter for Hui Ka Yan’s organization said Thursday that it might leave every one of its possessions in another sign that financial backers are losing certainty. Chinese Estates Holdings Ltd. sold 108.9 million Evergrande shares from Aug. 30 to Sept. 21, as indicated by an assertion to the Hong Kong trade.

Evergrande’s inland property unit had said in an ambiguously phrased recording that an interesting installment due the next day on one of its yuan-named bonds “has been settled through exchanges of the clearinghouse.” It didn’t indicate how much interest would be paid or when.

The recording “showed that keeping up with bond dissolvability was as yet on the plan for Evergrande and furthermore raised expectations for financial backers that leasers are to a degree open to goal,” said Justin Tang, head of Asian exploration at United First Partners. “The read-through is that a deliberate rebuilding/exchange is as yet on the cards for other inland and seaward banks and could purchase the time Evergrande so frantically needs.”

Dread that Evergrande could trigger fundamental dangers in China shook worldwide business sectors recently, prodding a huge number of investigators to contend that Beijing would offer sufficient help to such an extent that it will not turn into a Lehman second. Somewhere around seven Chinese banks have lately tried to mitigate financial backers over their openness.

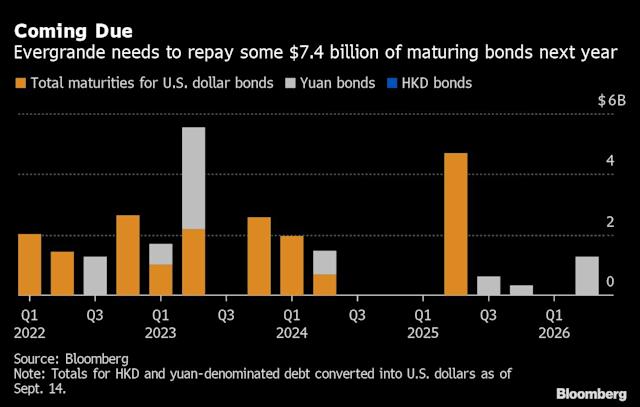

“In the event that an enormous default should be possible in an organized and ideally straightforward cycle, then, at that point, it can give financial backers trust in the framework,” said Loomis’ Chow, “This is particularly as defaults become a more customary component of China acknowledge market, in accordance with other worldwide credit markets.” Attention is currently going to an US$83.5 million coupon installment that Evergrande is scheduled to convey Thursday on the 2022 dollar note. The coupon on the 8.25 percent security, which has a 30-day beauty period before a missed installment would comprise a default, is important for US$669 million of bond interest due through the finish of this current year.

Evergrande’s 8.25 percent dollar bond due 2022 climbed 3.5 pennies on the dollar to 28.7 pennies as of 4:09 p.m. neighborhood time, as indicated by Bloomberg-assembled costs.

Additionally further developing financial backer opinion is a nearby media report that referred to Evergrande originator Hui as saying that the organization needs to continue development to guarantee smooth fruition of property projects. He additionally swore to guarantee reimbursement of the organization’s speculation items.

In a more extensive indication of a better state of mind in Asia’s dollar security market, four Chinese firms were offering new arrangements Thursday, finishing a three-day hush in the midst of occasions and worry about the virus from Evergrande’s obligation misfortunes. Indeed, even a garbage appraised engineer, Jiayuan International Group Ltd., was among the expected guarantors.